What if we could see what the market looked like assuming BTC was the reserve currency? The signaling mechanism of the stock market seems broken or unreliable in US Dollar terms - but if we priced stocks in crypto, the S&P500 is down - 75%.

For folks who haven’t heard of us before, we’re Pasiv Financial. A small soon-to-be-regulated fintech startup in Dubai building a wealth management app that will help you with zero commission trading and we’re a couple of weeks away from launch (Insh’Allah). If you live in the UAE - join our waitlist at http://pasiv.ae. We promise you a wicked app.

Today we have guarantees from the Fed & the ECB to print our way back to normalcy. Markets are at all-time highs in the middle of a raging pandemic. But the crypto asset class paints a whole new reality.

The last 365 days in the market have been the wildest we have seen, and some of us have been trading for a long time. The $GME debacle has marked a new era in markets and young investors everywhere are asking questions about their wealth, their savings, and how to invest. The youth is finally waking up and it’s a good thing.

We thought the market was in for a breather. But then Elon tweeted.

It got us thinking why in the world would the richest man on the planet even consider something so outlandish?

What happened to the AML rules that we all have to abide by? Will Tesla be your drug dealer’s Voiture du jour?

Surely it is reckless and probably attracts regulatory scrutiny encouraging folk to buy Doge, BTC, and other cryptos. Then we saw the “One Coin to Rule Them All” post, and we decided something has to be happening that we aren’t seeing.

Have central bankers broken the dollar? Is it not good enough anymore for Elon? Will other large companies follow Tesla’s example and effectively seed a parallel financial system?

The incredible money printing efforts of the world’s central banks have effectively sent asset prices through the roof or “to the moon” as we say these days. This is happening alongside a real economy that is grinding to a trickle pace with redundancies at record levels globally. Correlations have broken down between Wall Street and Main Street (albeit not the first time - some would argue it's been broken for some time now) and cryptos are breaking out.

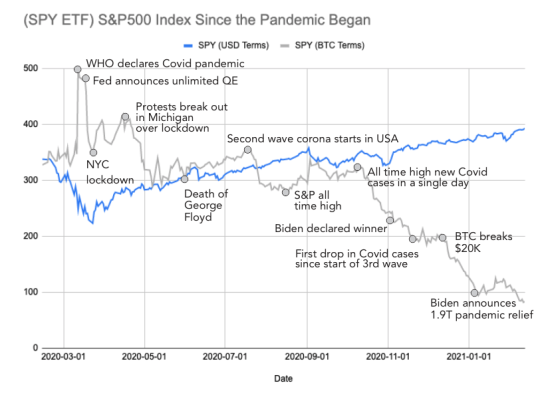

We decided to chart the S&P500 Index in BTC terms, instead of USD, and the result alongside some of the biggest Covid headlines of 2020 is remarkable.

Here are seven key takeaways about the chart of the S&P500 in BTC terms

- The market soared initially (probably due to margin calls) as the market in USD terms started collapsing forcing funds to liquidate their cryptos.

- The market fell sharply when the Fed announced unlimited QE: the ultimate acknowledgment that things could get worse.

- The market rose in recovery when NYC’s lockdown was announced; likely in relief that the authorities were taking control.

- The market fell again when Michigan refused to lockdown with protests breaking out; a precursor that the US libertarian wasn’t going to abide by Covid restrictions.

- The market fell when the second wave of Corona started in the USA; daily cases started rising again for the first time since they had peaked. This also marked the breakup between Dr. Fauci and the White House.

- The market rose when the S&P500 hit an all-time high buoyed by strong tech earnings and Nasdaq performance.

- The market started its final descent when daily Covid cases broke to an all-time high once again - a sign that more states were about to enter lockdown or impose restrictions.

We were partly expecting this outcome given the historic move in cryptos over the last two months, but we weren’t expecting the tops and bottoms to be this accurately timed with key Covid-related headlines.

Put simply - The market in BTC terms is showing signs of becoming a more effective signaling mechanism that reflects the real state of our world, free of speculative central bank money.

Is this the end of the dollar? Hardly.

Are these the early signs of what BTC’s creator had promised us all along? We are certainly quite intrigued at the institutional interest suddenly surrounding cryptos and the De-Fi movement. But the chart speaks a thousand words to those who understand monetary economics and the long-term consequences of fiat money printing.